Refreshing your mortgage preapproval is a good idea if it’s been a while since you initially applied, or if there have been any significant changes to your financial situation.

To help you with this task, I’ve partnered with Mandy Miller of First World Mortgage to compile of list of what you’ll need to do to get the ball rolling:

Mandy Miller

Senior Mortgage Advisor

First World Mortgage

Cell: 203-530-4361

Email: mandy@firstworld.com

- 📅Confirm Your Preapproval Expiration Date. Preapprovals usually last between 60 and 90 days. If it’s been longer than that, you may need to go through a new round of verification, especially if major life changes have occurred.

- 📞Contact Your Lender or Broker. Reach out to the lender or mortgage broker you worked with before, or consider contacting a new one if you’re exploring options. Let them know you’d like to update your preapproval.

- 💰Review Your Budget & Mortgage Goals. If your circumstances have changed—whether it’s an increase in your income, a shift in your down payment savings, or an updated goal for your home purchase—let the lender know so they can adjust their guidance.

- 📈Revisit Your Credit Score. If you’ve made any changes to your credit, like paying down credit cards or resolving disputes, this could positively impact your preapproval. On the other hand, if your credit has taken a hit, be prepared for that to affect the preapproval amount or interest rate.

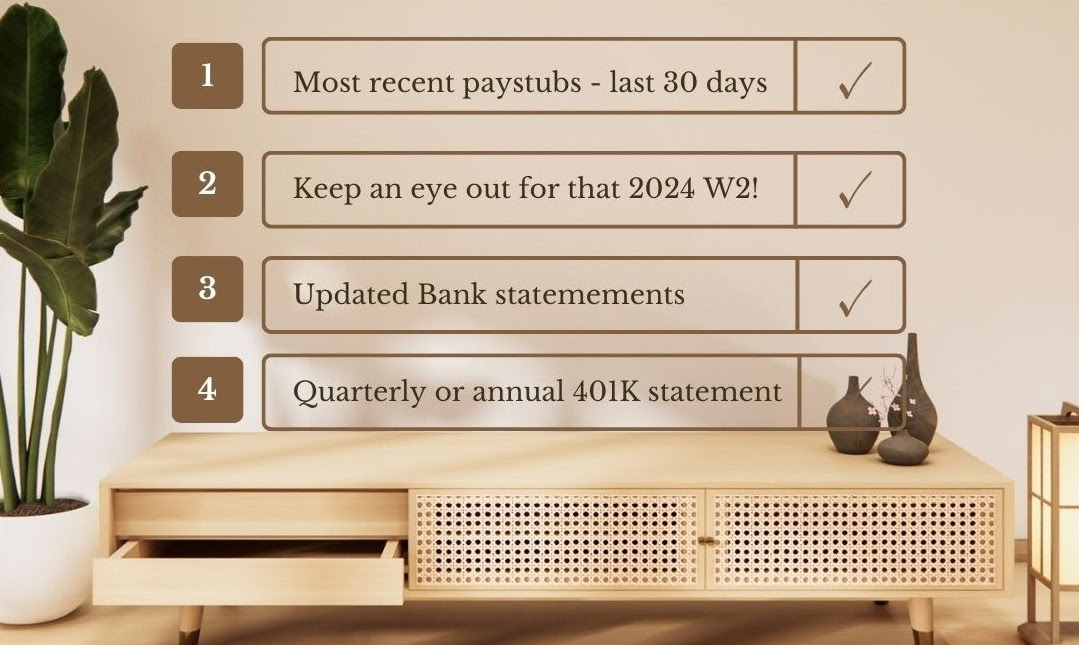

- 📄Provide Updated Financial Documentation. Lenders will need to reassess your current financial situation. This usually includes:

- Recent Pay Stubs: Typically, the last 2–3 pay periods.

- Tax Returns: The last two years of tax returns, including any W-2 or 1099 forms. **keep on the lookout for 2024 W2’s!

- Bank Statements: Most recent 2–3 months of statements from all accounts (checking, savings, etc.).

Once you provide the updated information, the lender will reassess your situation and provide you with a new preapproval letter. This updated letter will allow you to confidently make offers on homes, knowing you’re ready for financing!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link